Asset allocation by age group

Mid-career investors (40s-50s) should shift to 60-70% stocks, 20-30% bonds gradually.

Mid-career investors (40s-50s) should shift to 60-70% stocks, 20-30% bonds gradually.

Young investors in their 20s-30s can allocate 80-90% to stocks for aggressive growth.

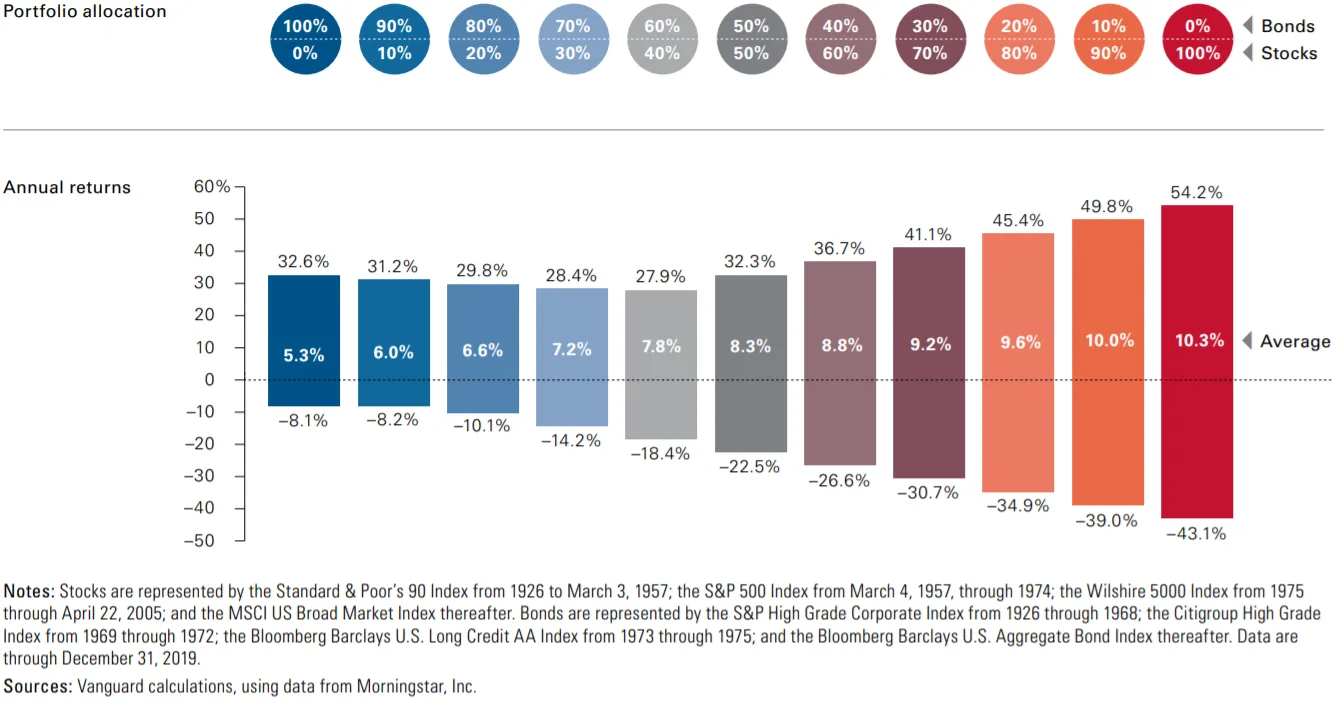

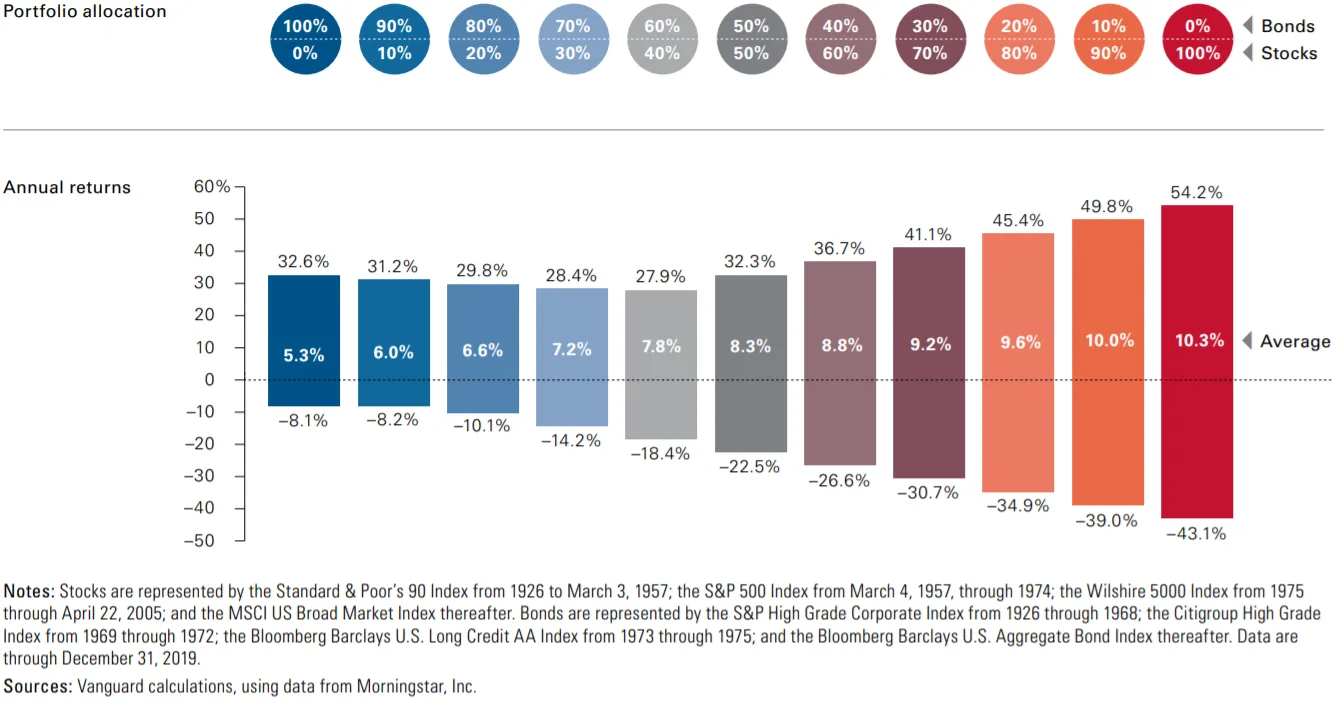

Asset allocation should adapt as investors age to balance growth and risk. Young investors (20s–30s) can aim for aggressive growth, with 80–90% in stocks and 10–20% in bonds.

Mid-career investors (40s–50s) should gradually reduce risk, shifting to 60–70% stocks, 20–30% bonds, and 5–10% cash or real estate. Preserving capital while pursuing growth is key.

Pre-retirees (late 50s–60s) need to prioritize capital preservation by moving towards 50% stocks, 40% bonds, and 10% cash. This mix cushions against market swings while maintaining growth.

Asset allocation should adapt as investors age to balance growth and risk. Young investors (20s–30s) can aim for aggressive growth, with 80–90% in stocks and 10–20% in bonds.

Mid-career investors (40s-50s) should shift to 60-70% stocks, 20-30% bonds gradually.